Sweet as.

Doubtful I used that correctly.

Events From Week 8

The Upwork catastrophe is resolved! HUGE thanks to Erica. Without your pressure on Upwork management and persistence, my freelancing career would be on life support. I am now free to take on clients again. Here’s a refresher on what’s available right now. Email me (terry@zenalytics.info) if you have any requests.

Series 65 Study was not up to par:

Only one day of study this week. Review and practice exam.

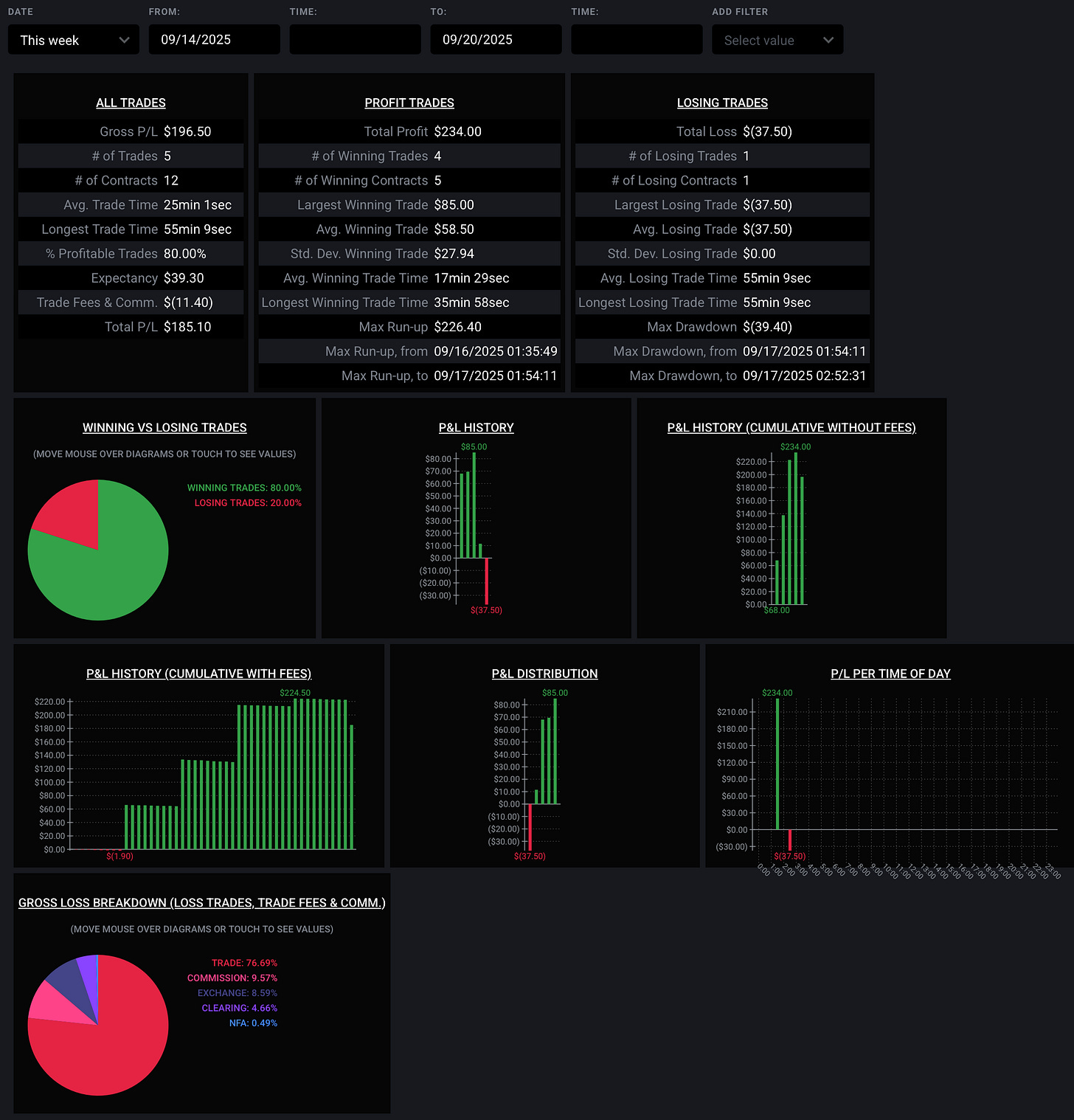

Prop Firm $50K day trading account:

Total Days Traded: 28

Total Balance: $55,804.50 (+11.61%)

Week 8 Commentary:

Quiet trading week, I was tired this week and didn’t make the late nights.

Only traded briefly on Monday and Tuesday. I sat in for the market open on Friday, but ended up not doing anything and packed up the computer early.

These late night/early morning trade days are not doable when we go out and adventure in the day.

What I Built / Shipped / Posted

This week I’ve been working on two projects.

The first deals with reporting to the CFTC (U.S. Commodity Futures Trading Commission). I use this data to determine how various market participant groups are positioned. This gives one an idea of where REAL sentiments lie. It’s one thing to say you feel bearish or bullish about the market, and it’s another, actually, to put money down on those feelings. I tend to rely on those actions, not words in articles or polls or on Twitter, so this data is invaluable.

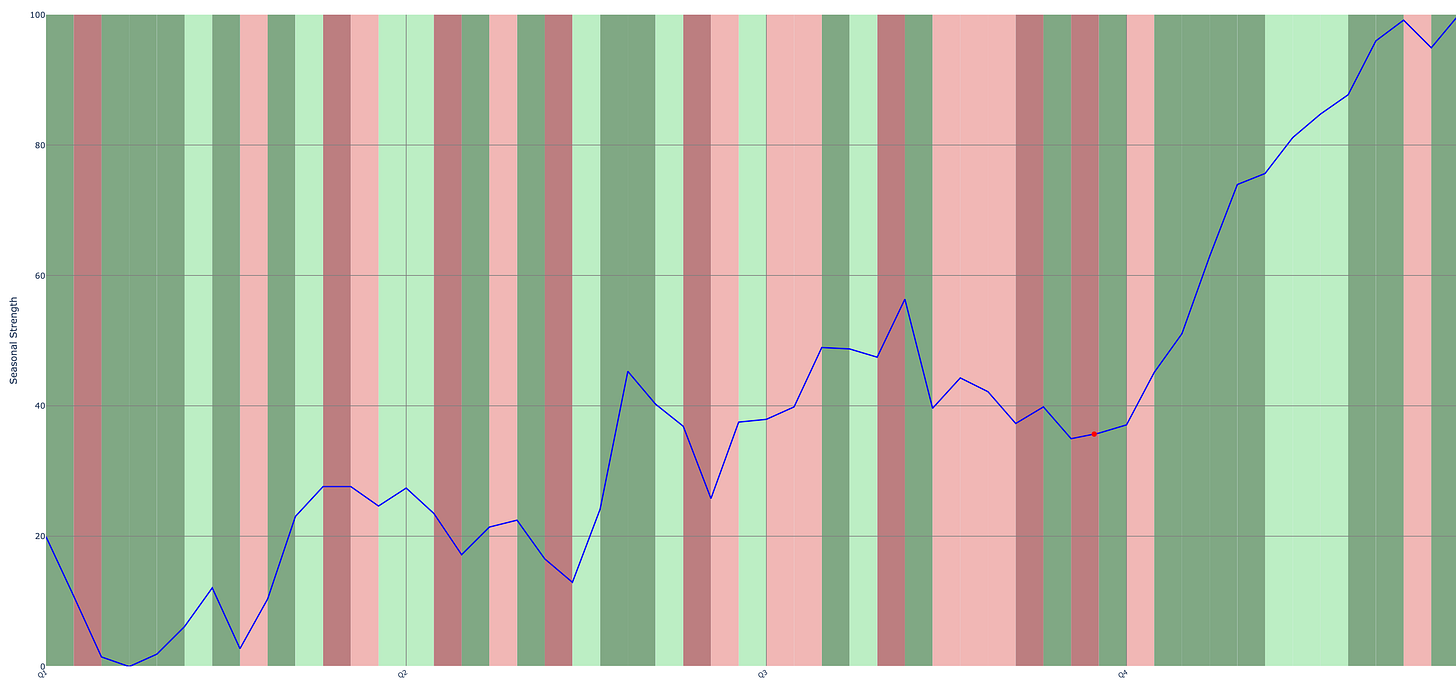

The second project, shown below, identifies the annual seasonality of an asset. The seasonal strength plot shows which weeks of the year Bitcoin typically goes up or down, with darker background shading illustrating more reliable patterns. The blue line shows the overall seasonal trend throughout the year. This image shows the seasonal patterns for Bitcoin. History suggests that we (one week before Q4) are entering the most bullish part of the year. I prioritize bullish trade ideas during consecutive weeks of dark green phases on various assets. I’ll specify these windows of time to search for seasonal trades like I mentioned in CQ6.

What I Learned

“I’m not a night owl anymore.”

I remember gaming/tv/movies/parties into the early morning hours and then heading to work bright and early the next day. That’s just not me anymore. This week was tough. Being in a new place, we were out and about during the day, seeing the sights. Even coming in to take a break and try to nap from 8 until midnight or 1, I was still having issues being mentally ready to trade when it came time for the market to open. This week, I’ll try to be better about that and moderate my coffee drinking time and use my blue light blocking glasses more so my brain can shut down easier when I need it to. That’s just going to have to work for the next two weeks because we aren’t really going to be slowing down that much. We have about a week here, and another trading week in the next place. After that, we spend a little more time in the following two locations. I’ll also be taking the Series 65 exam before we leave NZ, so I have to make time for trading and studying with odd hours.

What's Going On Next Week

More Series 65 studying.

SIE Studying begins.

A weekly trade idea post on Tradingview on Fridays.

A report on the Commitment of Traders data.

🤪 Off-Topic Corner

In New Zealand, people drive on the left side of the road. That’s not weird. What is strange, though, is that sidewalk traffic doesn't seem to follow that pattern. I would assume that folks would default to the same side of the sidewalk that they are used to driving on, but there’s almost no uniformity. People walk all willy nilly. I’ve never had so many of the you go this way, I go that way, oh no, I’ll go this way, you go that way mismatch, awkward sidewalk encounters in such a short time before. What’s up with that New Zealanders?

My Current Location: Hamilton, New Zealand

There’s a neat little volcanic island after a short ferry trip from Auckland called Rangitoto. It’s a protected island, basically just a place to go hiking on trails around the island and up to the summit/crater. There’s no public infrastructure. We took a side trail off to some lava tunnels, I’d guess less than a quarter of a mile long. It was an extraordinary experience thinking about this whole space being filled with lava at one point. This particular island/volcano is the youngest in the area, at 600 years old.

Thanks for following my "finance in public" journey!

If you have any questions or comments, drop them below! I’d love to hear from you.