Pencils Down...

Big exam coming up...

Events From Week 22

Series 65 review and coding projects.

Test is Wednesday!

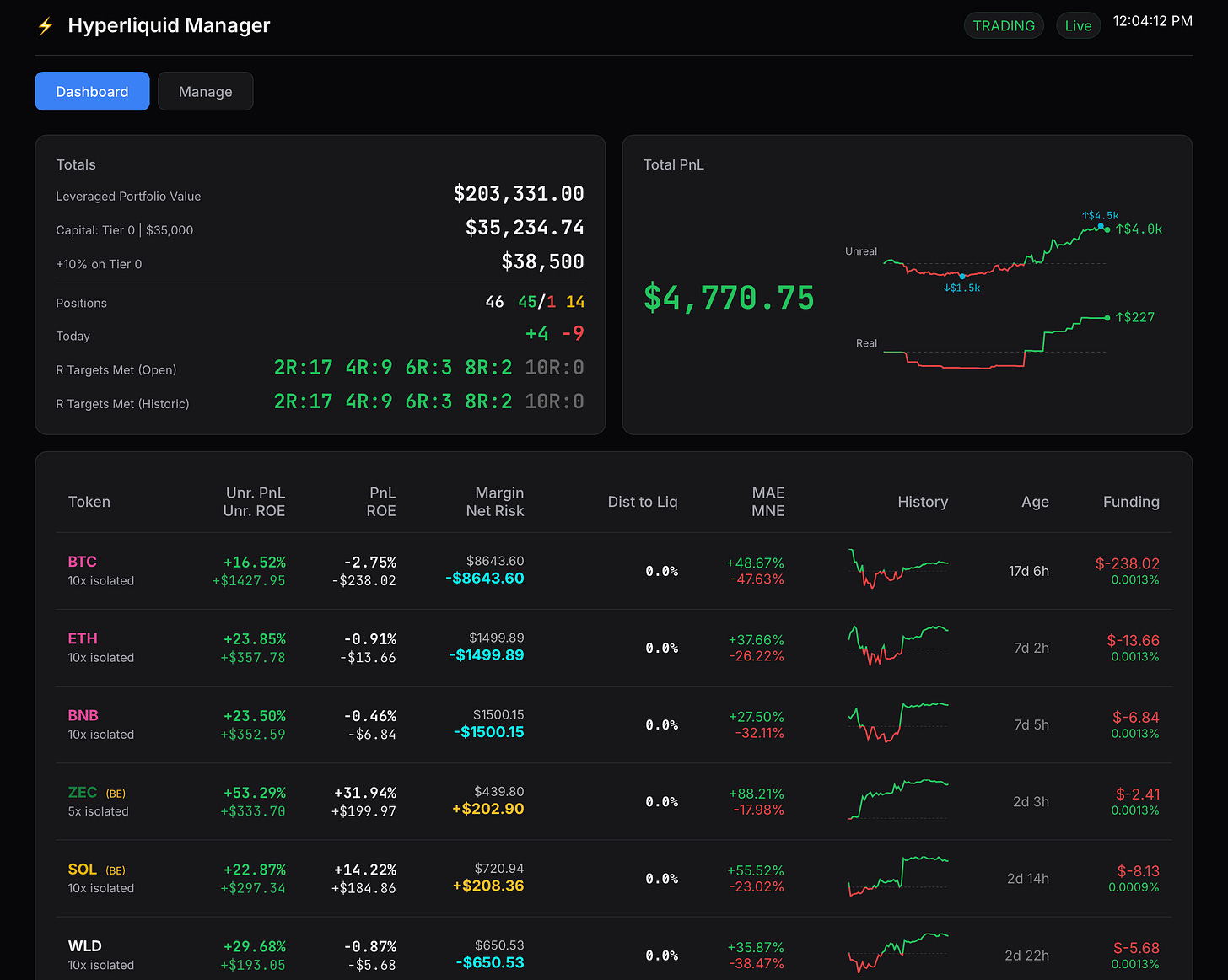

The HyperLiquid Position Manager coding is going really well.

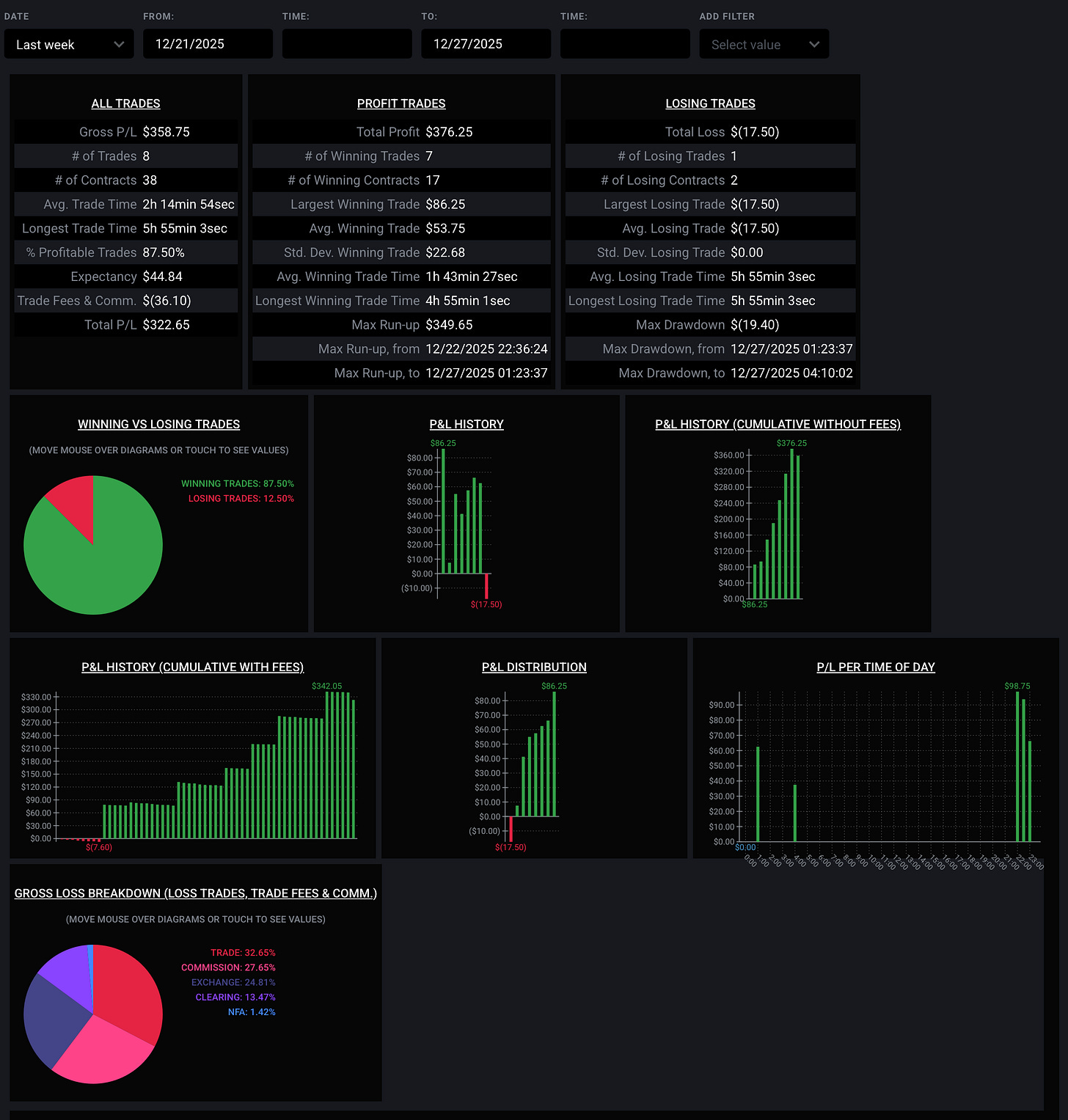

Prop Firm $50K day trading account:

Finally got some trades in.

Total Days Traded: 41

Total Balance: $57,026.4 (+14.05%)

Week 19 Commentary:

Couldn’t stay up too late most days so took smaller early morning trades.

What I Built / Shipped / Posted

I’ve been really excited working on this position manager code. Once it’s all done, it’s a product that I can implement across markets since there’s api connectivity to both my crypto and tradfi platforms.

Right now it’s just dealing with crypto and testing on the Hyperliquid Exchange, because that’s easiest for me right now. It’s also just managing the breakout methodology I mentioned last week. Since I believed we were near a bottoming point for a couple weeks now I’ve been waiting for the breakout setups to appear. I’ve had to endure a little bit of choppiness and small stops but things are moving to the positive now.

Below is the primary dashboard that will display my open positions and other info. Some of the data is really only relevant for my purposes/procedures (which are relatively niche) so it’s not really a marketable product in this form. Also I’m still fiddling with the things I do/don’t want included on the display.

Here’s the neat part, though. The program monitors my positions and scales out automatically based on my methods, leaving a little runner after I’ve profited 10 times what I risked losing.

It has been running smoothly for the past few days. I still have some stop-loss and breakeven stop-trade logic to implement, but this has been pretty powerful so far. I still open positions manually because there’s always some level of discretion I use on my systems. I’m like 80% automated, 20% discretionary.

What I Learned

“I don’t love tests...”

I haven’t had to take a test in I don’t know how many years. I’ve been studying and taking practice tests, but I still feel nervous about the Series 65 exam. This is a pretty crucial first trial on this path, so I think that’s adding to the pressure. It’s not the end of the world if I fail; I retake it. It’s also not uncommon for people to fail. It is a hard test, and they design it to trip you up (which I think is dumb for any test).

I think what also adds to the frustration in the back of my mind is that failing would reflect poorly on me, even though I know that’s not true in the front of my mind. I have done some incredible work, learned a great deal, and am a strong analyst, forecaster, and trader. This exam’s grade doesn’t even come close to where I rate myself as a market professional.

But I also need the grade…

What’s Going On Next Week

Series 65 exam

celebratory deep tissue massage to de-stress???

Moving to next city in Vietnam

🤪 Off-Topic Corner

My Current Location: Ho Chi Minh City, Vietnam

Scooters and motorbikes are the primary mode of transportation here. It’s neat/funny seeing how people manage to get around, like anywhere else in the world, within this framework. Gotta haul a washing machine? Build a mount, put it on the back, and strap it down. Gotta take the dogs to the park? Have one sit on the back seat, and the other on the footrest between your legs. Gotta take your cat to the vet? Put it in your purse.

Thanks for following my “finance in public” journey! If you have any questions or comments, drop them below! I’d love to hear from you.