Basically PNW...

Seattle has more gray/wet days, but I feel like we are getting all the ones here...

Events From Week 9

Another quiet week. We had a friend visit us, so we spent a lot of time doing touristy things.

Series 65 Study:

Two study days. Unit 14 and 15 review and practice tests.

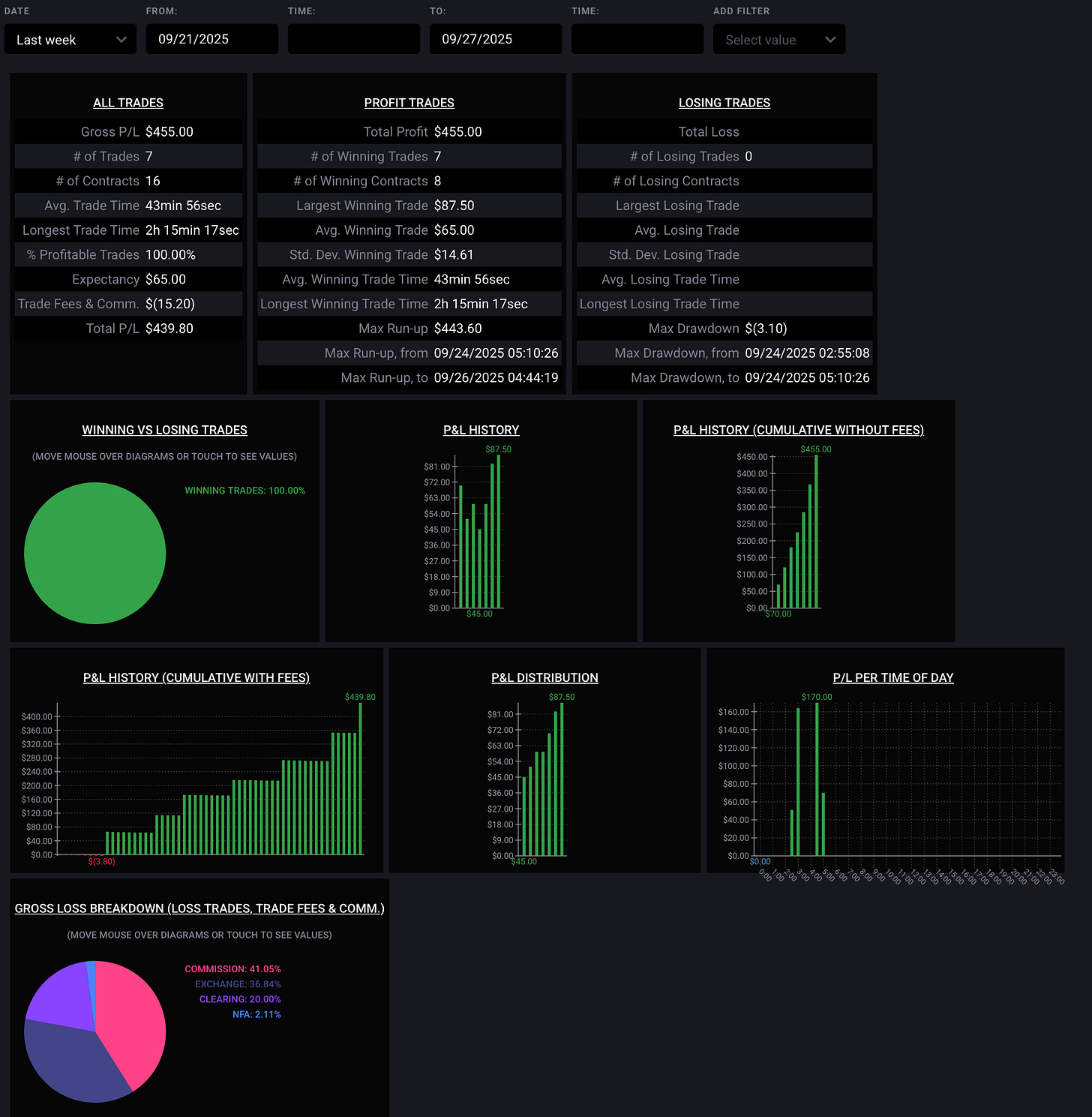

Prop Firm $50K day trading account:

Total Days Traded: 31

Total Balance: $56,244.3 (+12.49%)

Week 8 Commentary:

Slept through my alarm on Monday. I didn’t have any setups I wanted to take on Friday.

Both Tuesday and Wednesday were small wins early on, then I hit the bed.

Thursday, I caught the bottom early in the trading day and had a decent ride to the top of the range.

What I Built / Shipped / Posted

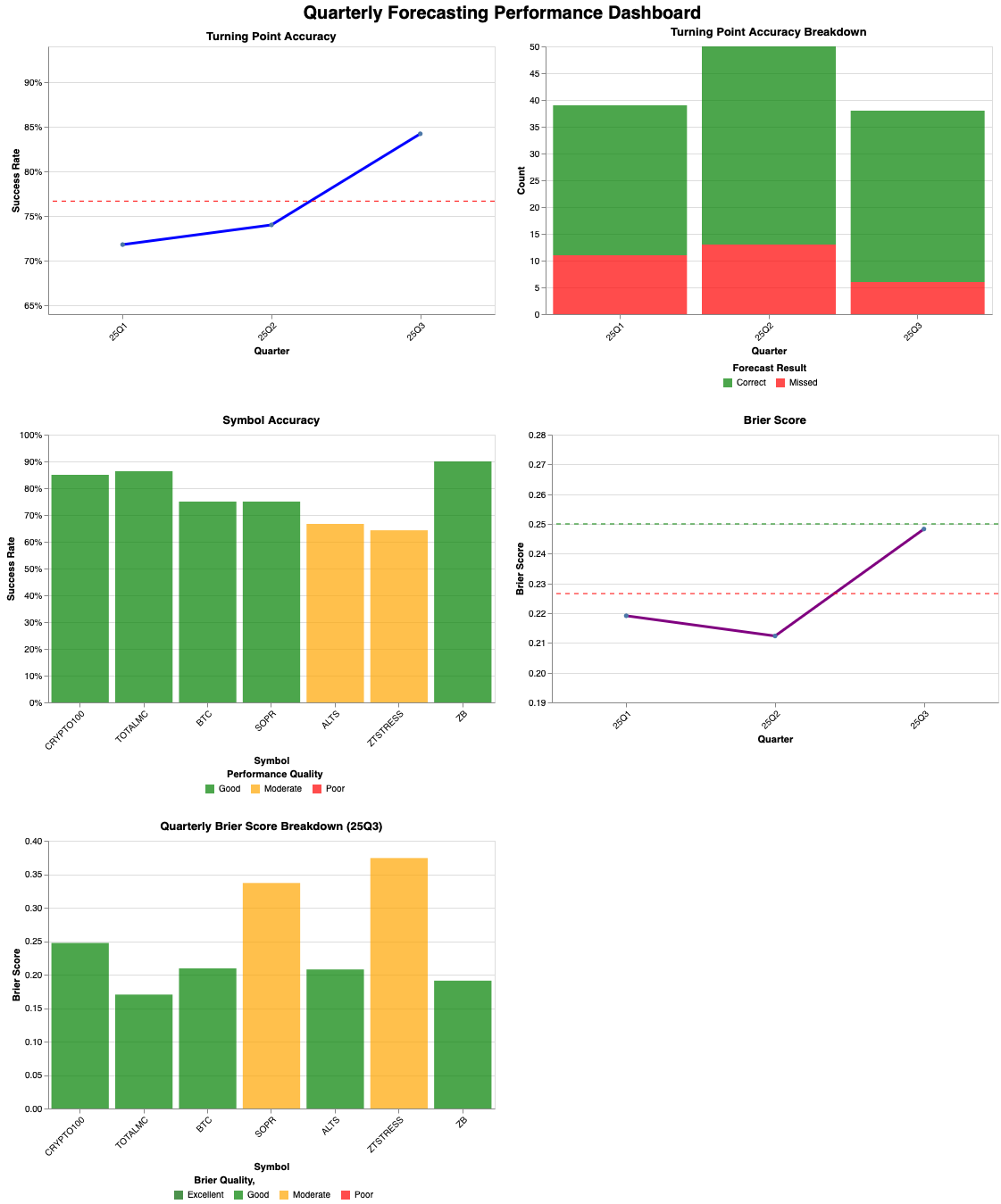

he crypto market has been dominating my coding projects. I’ve been creating frameworks to automate a significant portion of my data collection and calculations for my quarterly forecasting newsletter. It is, by far, the post that takes the most time for me to create, and any time saved here will pay dividends. In addition to the automations I’ve built, I’ve made a simple dashboard to complement my accuracy report, which I also publish. I’ve been creating public models for Bitcoin since early 2021. Out of 86 turns since then, so far, 67 have been validated, which puts my forecasting accuracy at over 75%. Below are the results of 2025 across the various models I made in the reports. This year, I added an extra metric (Brier score) to provide a more comprehensive review of my forecasting abilities. I include how likely the model is to capture turning points. This probability, combined with the actual results, will not only show how accurate I have been but also how well my predicted probabilities align with actual outcomes. The Brier score measures the accuracy of probabilistic predictions, so a lower score means my forecasts are both well-made and able to distinguish between likely and unlikely events. Lower scores suggest that if I think something is very unlikely, it is more likely that my assessment will be accurate. Ideally, I maintain a score under 0.25 on the Brier scores.

• 0.00: Perfect probabilistic accuracy

• 0.01–0.10: Excellent calibration (the forecast probabilities closely match the observed frequencies)

• 0.11–0.20: Very good calibration

• 0.21–0.30: Moderate skill (the forecast has some predictive power)

• >0.30: Poor calibration or unreliable confidence (no better than random guessing)

Forgive the crappy display. I’m still learning the visualization package Altair, and I haven’t quite figured out all the annotations and legends yet, so this is an extremely rough draft.

What I Learned

“Disclosure, Disclosure, Disclosure.”

This isn’t new to this week in particular, but it is stressed a lot in the units I’ve been reviewing. There’s lots of leeway given in the industry. Don’t get me wrong, there is a lot that is illegal, but there’s also plenty of stuff you can do that would make someone shake their head, as long as you tell the participants you are doing it first and give them the opportunity to decline before transactions settle. I imagine it’s akin to contracts with a book’s worth of fine print, expecting most folks to gloss over it, and you can give yourself some preferential treatment as a dealer or representative. It may be worth reading over your contract agreements with your brokerages to see what you’ve agreed to.

What's Going On Next Week

More Series 65 studying.

SIE Studying begins.

A weekly trade idea post on Tradingview on Fridays.

Continuing report on the Commitment of Traders data. Finished assessment on Dow Jones.

🤪 Off-Topic Corner

My primary mode of exercise while we travel is jumping rope. I can’t exactly pack around weights, and for some reason, I can’t be happy with only bodyweight workouts. I recently watched a video about jump rope routines of the boxing greats, and it was pretty interesting. I have been thinking a lot the last couple of days about my form and focusing on fundamentals to improve. I stopped jumping for a couple of months, and now I feel like I’m starting all over again, out of sync, tripping on the rope a lot. I think it’s because I never really did think about my form much and just pulled out the ropes and jumped. I have to work on this.

My Current Location: New Plymouth, New Zealand

We took a day trip to Hell’s Gate, a geothermal park located in the Rotorua area. On the tour after the first set of pools, you are met with this, Kakahi Falls. This is the largest hot waterfall in the southern hemisphere. Temperatures in the falls range from around 104°F to 122°F (40°C to 50°C). Some of the pools in other areas of the park are so hot that it’s pretty much boiling battery acid. I’m sure it wasn’t pleasant figuring out which ones were safe or not, because they are all spread out and mixed throughout the area, depending on where the cracks from underground end up.

Thanks for following my "finance in public" journey!

If you have any questions or comments, drop them below! I’d love to hear from you.